There are many factors that go into the asset division among couples during the divorce process. The process is predicated by state law. To determine the division of property, the courts look to the factors enumerated in DRL 236B. In New York and Massachusetts asset division is defined as equitable distribution.

Equitable distribution means the courts will attempt to make sure the assets are divided in a fair way under the circumstances. This does not always mean a 50/50 split. Even in a 50/50 split you need to know the tax consequences of each asset being divided. This means you also need to know the tax basis of your assets. Otherwise, a 50/50 split may not mean a true 50/50 split.

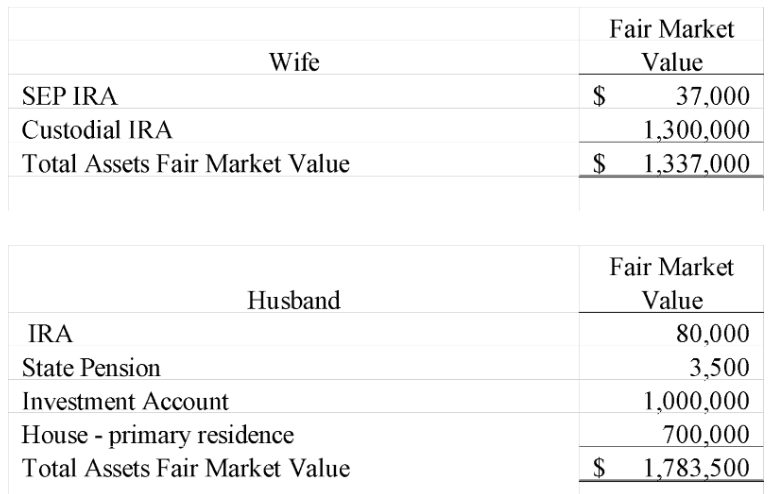

For example, assuming husband and wife have the following assets each will keep post-divorce.

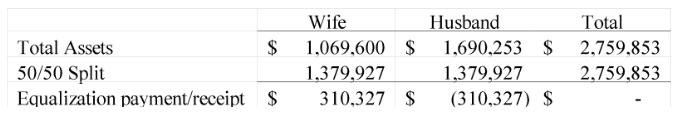

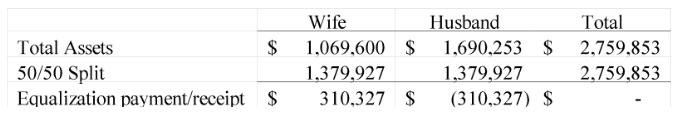

If the assets were to be split equally, the husband would have assets more than $446, 500 and would owe the wife an equalization payment of $223,250 shown as follows:

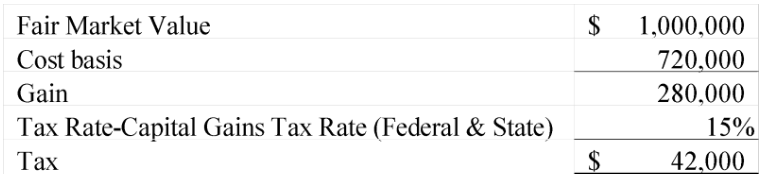

However, certain assets may have different tax consequences that need to be taken into consideration. The house is the couple’s primary residence, and they qualify for a capital gains tax exclusion since they have lived there for two of the past five years. The investment account has a tax basis of $720,000 resulting in a capital gains tax of $42,000 at capital gains tax rate of 15% (both federal and state).

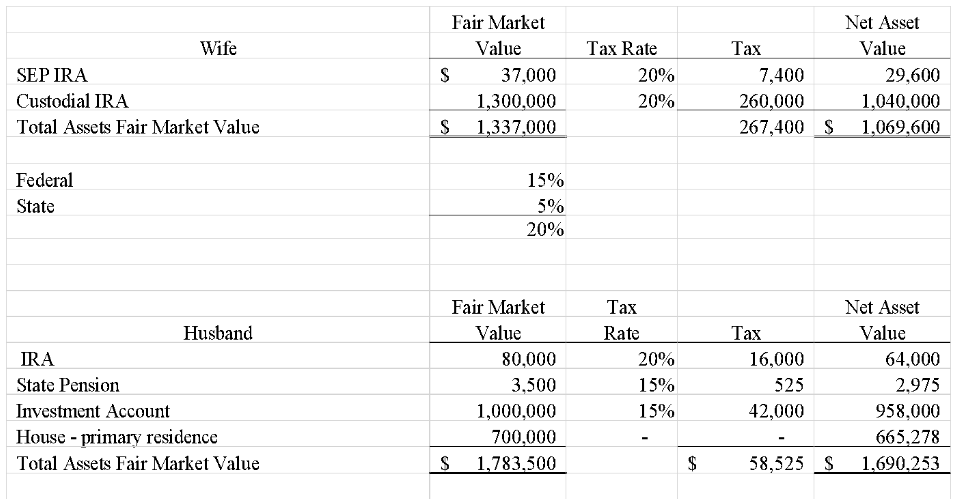

All the other assets would be taxed at their individual tax rates based on income of 20%, except for the state pension, which is not taxable at the state level.

Now when we look at the net asset value after consideration of tax consequences the asset division looks much different.

Taking tax considerations into account becomes essential to equalize the asset division, leading to adjustments in the equalization payment. By factoring in the tax implications of each asset, the process ensures a more balanced and fair division of assets between the parties involved.

It is important to understand that asset divisions are done on an after-tax basis and therefore not all assets are created equal unless the tax consequences are taken into consideration. A 50/50 split may not be a true 50/50 split without the help of a Certified Public Accountant trained in divorce financial planning.

Comments are closed.